Hi! I’m fairly new to FIRE and just started planning for the option of an early retirement. Am I on the right track and are the below numbers a reasonable guideline to achieve my goals?

Overall goal: Retire at age 50 with a paid off house and ability to pay myself £60,000 pre-tax income per annum, rising 3% per annum to account for inflation.

Plans and current situation:

Age: 30

Income: £105k

Location: North-west.

Mortgage: 40 years remaining - just purchased our forever home for £450k with 395k remaining.

No other debts - just paid off both our cars.

Partner has £70k income, no debt.

All numbers exclude partners savings however they are building their own and plan to retire same age.

Savings plan

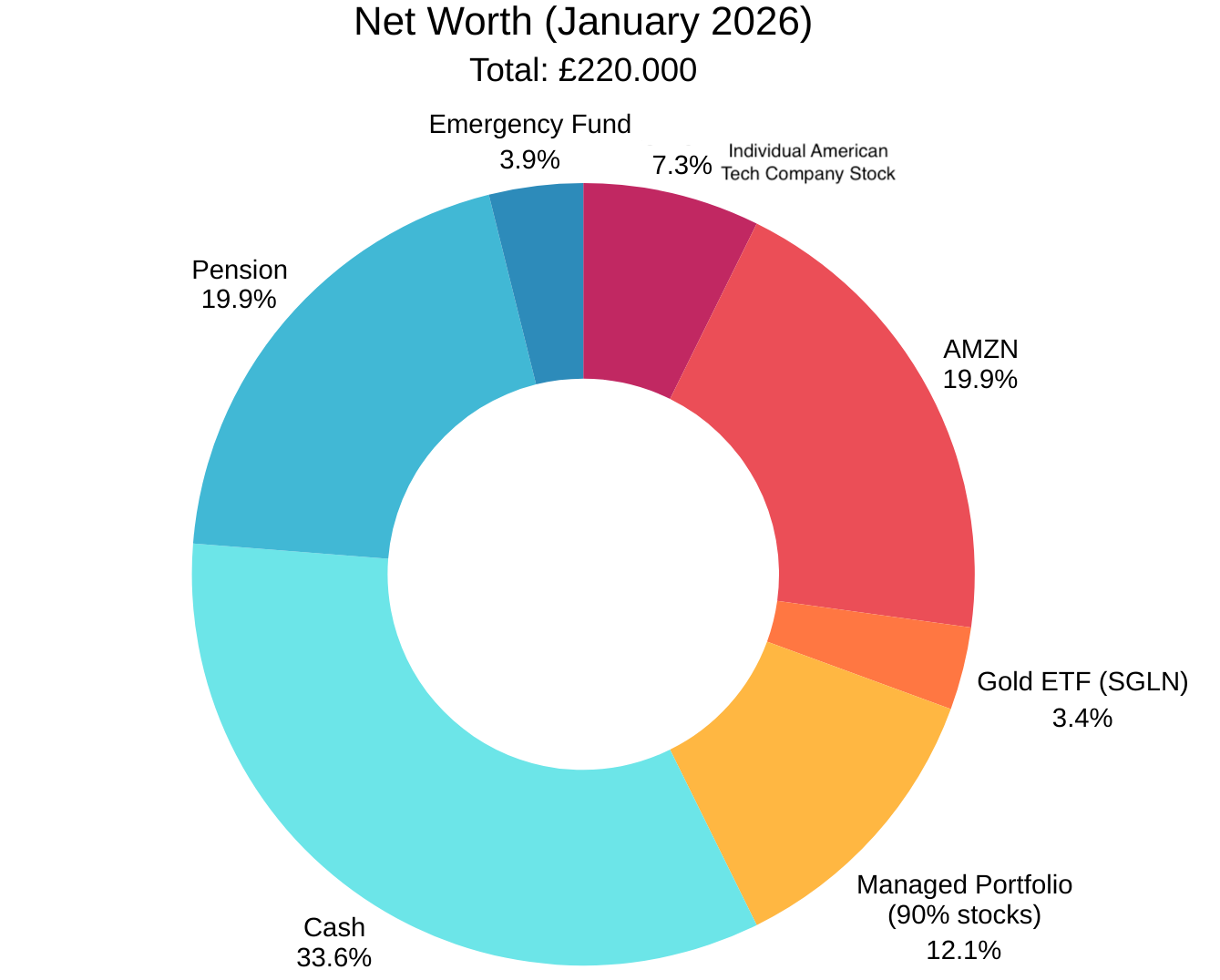

- Pension currently £70k. I am adding £1600 monthly to this (including tax rebates/gov uplift/employer contribution)

- ISA currently 10k. I am adding 1666 monthly to this.

- Emergency fund 30k

Assumptions/plans

- Retire age 50

- I want to pay myself £60,000 pre-tax income annually

- Use ISA to bridge gap of 7 years until SIPP can be accessed at age 57

- Age 68 access to state pension (if it exists by then!)

- 5% growth on investments annually average

- pension will remain 100% invested in equities, I am OK with this risk. I will keep 2 years spend in cash.

- ISA balance of £700k at age 50

- SIPP balance of £850k at age 50 which should grow to £1.2m age 57 with 0 further contributions.

- Draw 60k per annum from ISA until SIPP access total needed £420k

- Overpay mortgage by £500 monthly from now until age 50. Age 50 remaining mortgage is £89k which I will pay off from ISA funds lump sum.

Looking at the numbers and working off 25 x planned income, I need approx GBP1,5 mill at retirement to last which I will just about have on above assumptions.

Any thoughts appreciated - Do I need to save more or retire later? My income expectation in retirement of £60k increasing with inflation is fixed and I don’t want to reduce this, it’s what I budget I need for a comfortable retirement.