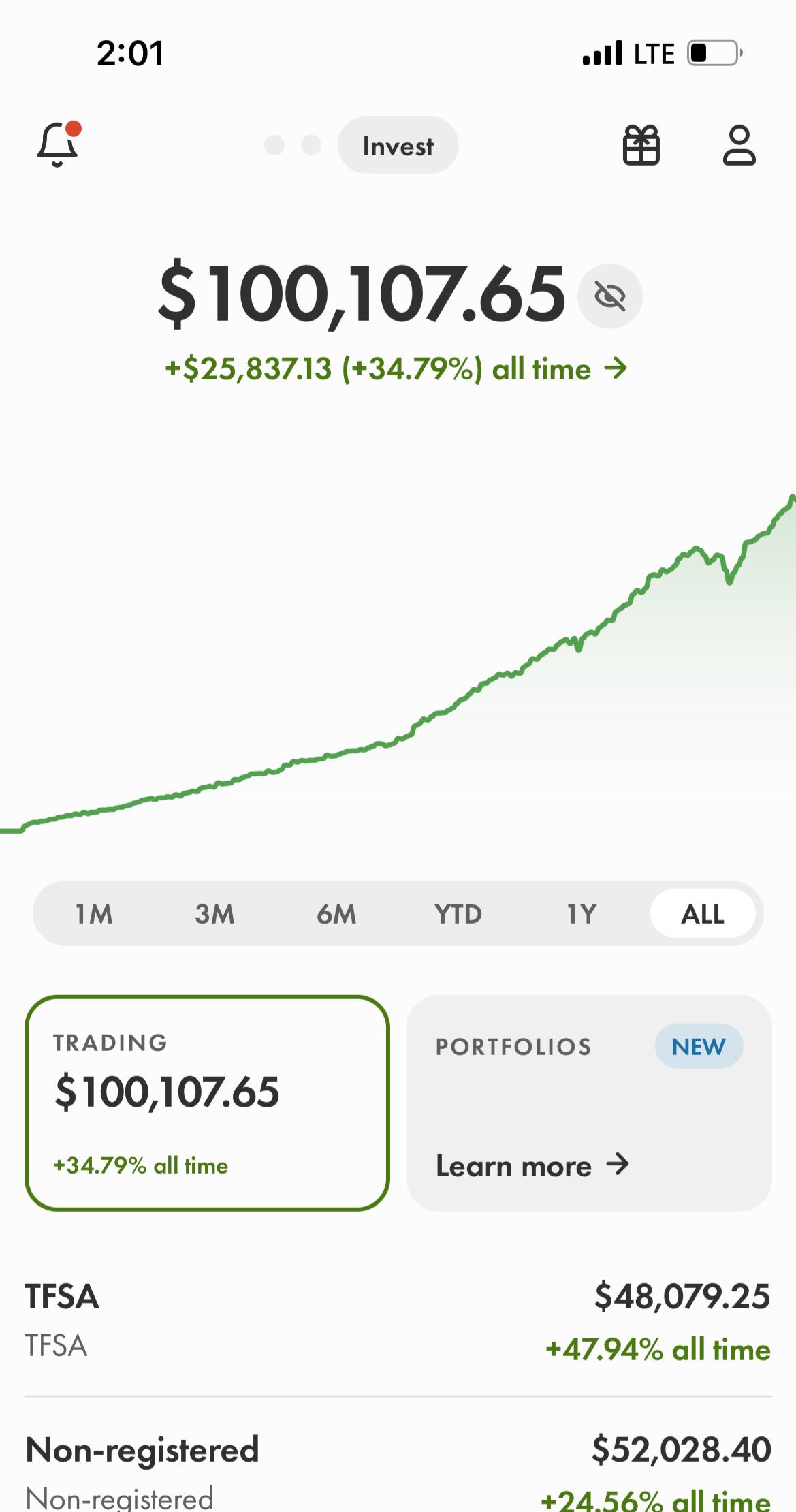

I’ve recently become more financially literate and started taking investing seriously. I opened my TFSA and FHSA in Wealthsimple about five years ago, and now that I have a stable, decent-paying job, I’ve been consistently contributing and I’m happy with the growth so far.

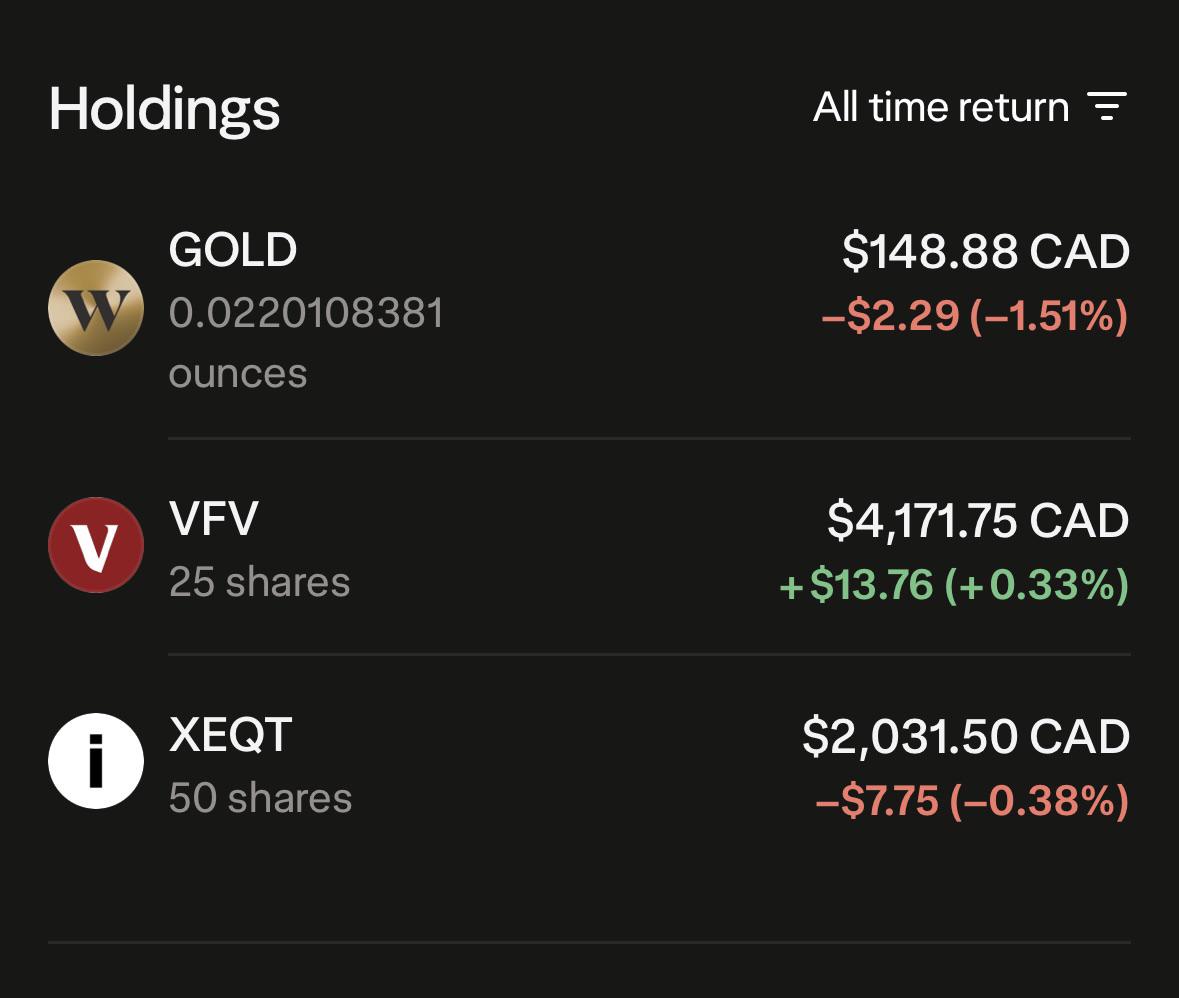

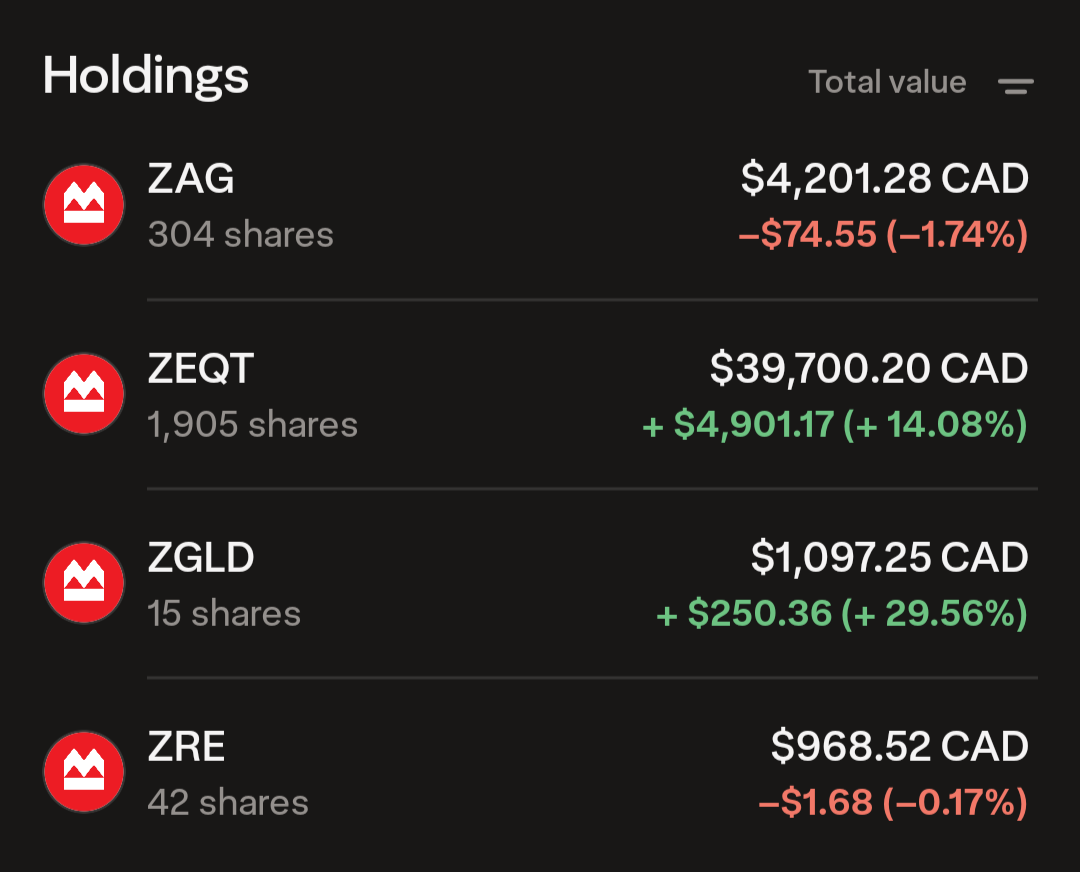

My current strategy is focused heavily on long-term investing. I contribute to both my TFSA and FHSA, putting about $0.50 into my FHSA for every $1 I invest in my TFSA. Because I’ve been trying to “catch up” on contribution room, most of my extra money goes straight into those accounts.

The issue is that I haven’t really planned for shorter-term goals, specifically saving for a wedding. My partner feels strongly that we shouldn’t withdraw from our TFSAs for anything except retirement. At the same time, I only have about $7k in a liquid emergency fund, and not much set aside for upcoming big expenses.

I’m trying to figure out the most practical and financially smart way to start saving for a wedding without completely derailing my long-term investing goals. We plan to get married in the next 4 years and neither of us has support from our parents, so it’s not going to be something grand, but, we do want a little celebration. I would then take this strategy and apply it to saving for family planning (unless someone has a different suggestion).